Understanding how to repay your federal student loans can save you a lot of time and money. We’re here to help you manage repayment and answer any questions you have along the way.

Finding the Right Repayment Plan for You

- You’ll be asked to choose a plan. If you don’t choose one, you will be placed on the Standard Repayment Plan, which will have your loans paid off in 10 years.

- You can switch to a different plan at any time to suit your needs and goals.

|

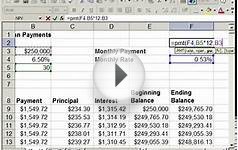

Use the Repayment EstimatorThe Repayment Estimator can help you figure out which repayment plan is best for you. Log in, and we’ll pull in relevant information such as your loan amounts, loan types, and interest rates. Just enter some additional information, such as your income and family size, and your results will show what your payments would be under each repayment plan. |

How to Make a Payment

Your loan servicer handles all billing regarding your student loan, so you’ll need to make payments directly to your servicer. Each servicer has its own payment process and can work with you if you need help making payments.

Never miss a payment.Got a Direct Loan? Sign up for automatic debit through your loan servicer, and your payments will be automatically taken from your bank account each month. As an added bonus, you get a 0.25% interest rate deduction when you enroll!

What to Do If You Can't Afford Your Payments

If you’re having trouble making payments, don’t ignore your loans. We offer several options that can help keep your loans in good standing, even if your finances are tight.

3 Ways You Can Keep on Track With Loan Payments

|

hange your payment due date. Do you get paid after your student loan payment is due each month? If so, contact your loan servicer and ask whether you’d be able to switch the date your student loan payment is due. |

|

Change your repayment plan. What you ultimately pay depends on the plan you choose and when you borrowed. If you need lower monthly payments, consider an income-driven repayment plan that’ll base your monthly payment amount on how much you make. |

|

Consolidate your loans. If you have multiple student loans, simplify the repayment process with a Direct Consolidation Loan—allowing you to combine all your federal student loans into one loan for one monthly payment. |

“How to Manage Your Student Loans” Video

Check out this video to learn more about changing repayment plans, postponing or reducing your payments, or combining your federal student loans. (Captioning available in English and Spanish; just start the video and click on the CC symbol at the bottom.)