Most students in the United States depend on public schools for their education, so it’s not surprising that the public has a keen interest on how tax dollars are spent to support public education.

Most students in the United States depend on public schools for their education, so it’s not surprising that the public has a keen interest on how tax dollars are spent to support public education.

Children sitting in classrooms, riding buses, eating school lunches, participating in school programs are our nation’s future, so we want to provide them with a good start in life.

Looking at details such as the source of revenue or spending categories gives us a better idea about how our tax dollars are being spent – i.e., how much of total spending goes toward instruction, how much toward children’s nutrition, how much for transportation, salaries, etc.

Funding public education in the United States is a joint effort between federal, state and local governments—and is the single largest category of state and local government spending. It’s vital for government leaders, school officials, policy makers and organizations that support education to understand how we are funding and operating our public school systems.

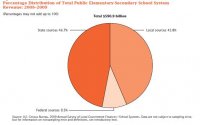

Of the money received by public school systems, 91 percent came from state and local sources; 9 percent came from the federal government. The $591 billion in total funding in 2009 works out to about $10, 499 per pupil, a 2 percent increase from 2008.

Of the money received by public school systems, 91 percent came from state and local sources; 9 percent came from the federal government. The $591 billion in total funding in 2009 works out to about $10, 499 per pupil, a 2 percent increase from 2008.

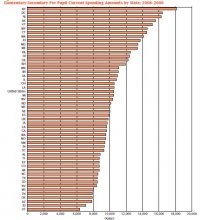

Public schools in New York spent more than any other state or state equivalent, with $18, 126 per pupil in 2009. The District of Columbia ($16, 408), New Jersey ($16, 271), Alaska ($15, 552) and Vermont ($15, 175) had the next-highest spending.

Public Education Finance: 2009 provides the most recent and complete picture of how taxpayer money is being spent on education.